The Of Paul B Insurance

Just like exclusive health insurance coverage plans, which we'll talk about following, government health insurance coverage programs try to manage quality and prices of treatment, in an initiative to supply decreased expenses to the insured. They may not be as high as with various other kinds of insurance.

After you have actually identified the main kind of health and wellness insurance policy based on its source, you can additionally classify your coverage by the kind of plan. A lot of health and wellness insurance policies are managed care strategies, which just implies the insurer deal with different medical suppliers to develop and also work out expenses as well as high quality of care.

The Greatest Guide To Paul B Insurance

However the deductibles, as well as other out-of-pocket prices like copayments and also coinsurance for a health insurance plan will certainly differ based upon your insurance company as well as just how much treatment you seek. A high-deductible health insurance (HDHP), which allows the guaranteed individual to open an HSA account, may be an HMO with one insurance provider, and an EPO with another.

Still, picking medical insurance can be effort, even if you're choosing a strategy via your company. There are a great deal of confusing terms, and also the process forces you to concentrate regarding your health and also your funds. Plus you have to navigate all of it on a target date, frequently with just a few-week duration to explore your options as well as make decisions.

Asking on your own a couple of basic concerns can help you zero in on the right plan from all those on the marketplace. Right here are some pointers on where to look and how to get credible suggestions and also aid if you need it. It's not constantly obvious where to look for health insurance.

, where you can go shopping for insurance in the marketplaces created look at this now by the Affordable Treatment Act, likewise known as Obamacare.

The Definitive Guide to Paul B Insurance

Also with lots of options, you can tighten points down with some standard concerns, De, La, O claims. If you're quite healthy, any of a variety of strategies could work.

Occasionally you can enter in your drugs or physicians' names while you browse for strategies online to filter out plans that will not cover them. Is my medicine on the strategy's formulary (the list of drugs an insurance strategy will cover)?

If you picked that strategy, you would certainly be wagering you won't need to make use of a whole lot of wellness services, therefore would just have to stress over your hopefully inexpensive costs, and also the expenses of a couple of appointments. visit this website If you have a persistent clinical problem or are just more danger averse, you may instead pick a strategy that has called up the amount of the costs.

A Biased View of Paul B Insurance

That method, you can go to a lot of consultations and choose up a whole lot of prescriptions and still have convenient monthly expenses. Which strategies are available as well as cost effective to you will differ a whole lot depending on where you live, your earnings and also who's in your home and on your insurance coverage.

gov or onyour state's ACA insurance exchange. Still feeling bewildered with all the ACA selections? You're in here luck. There is complimentary, impartial expert aid available to help you choose as well as enlist in a strategy. Simply placed in your postal code at Healthcare. gov/localhelp and search for an "assister" a person likewise described as a healthcare navigator on some state internet sites." Aaron De, La, O is one such navigator, and keeps in mind that he as well as his fellow overviews don't deal with compensation they're paid by the federal government.

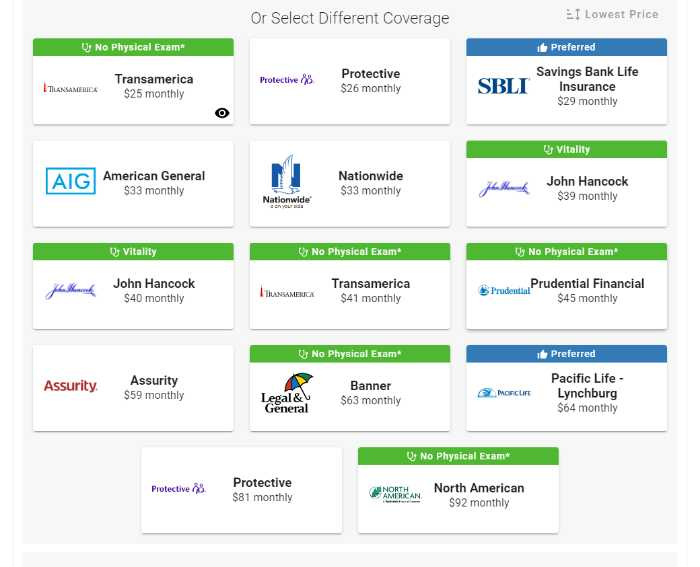

The internet can be a scary area. Corlette claims she alerts people: Do not put your call details in health and wellness insurance passion forms or click on on-line ads for insurance!

"However, there are a great deal of disadvantage artists around who take benefit of the truth that individuals acknowledge health and wellness insurance policy is something that they ought to obtain," says Corlette. She informs people: "Just go right to Healthcare. gov. Whatever state you stay in, you can experience that portal." Any kind of plan you discover there will certainly cover the ACA's 10 vital advantages such as free precautionary treatment and also healthcare facility coverage.

6 Simple Techniques For Paul B Insurance

This year, the subscribe period for the Health and wellness, Care. gov marketplace prepares that go into impact in January 2022 begins Nov. 1, 2021 and runs till Jan. 15, 2022. If you're registering for an employer-sponsored strategy or Medicare, the due dates will be various, however probably additionally in the fall.

:max_bytes(150000):strip_icc()/InsurancePremium_Final_4194539-49c5df26fba746b0b9d16de6e302fdf5.jpg)